Medical insurance (account code 111500) is a fringe benefit for full-time salaried employees. Unlike other fringe benefits (i.e. Social Security), which are calculated as percentages of the salary, medical insurance is a flat-rate based on months of predicted service for that position within the fiscal year.

Whenever the budget for a full-time salaried position is transferred using a budget revision form, the budget for fringe benefits, including medical insurance, must be transferred as well. In order to ensure accuracy in position budgeting, the new budget revision e-form will automatically calculate the amount of fringe benefits for the user. Medical insurance, however, will need to be manually calculated and entered.

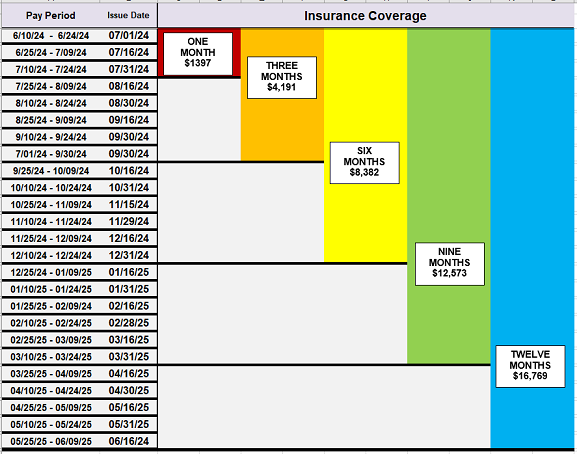

Use the table and payroll calendar below to calculate the amount of medical insurance budget to transfer with the position salary. This figure is based on the months remaining in the current fiscal year. For example, if the budget for a full-time salaried position is being transferred in January, only six months of medical insurance budget will need to be transferred.

PLEASE NOTE:

- If the transfer is permanent, be sure to check the Permanent box on the e-form and use the 12 month calculation. One, three, six, and nine month calculations can only be used on a temporary budget revisions.

- Medical insurance budget only needs to be transferred if the FUNDING for a salaried position is being transferred. Salary increases or decreases within a position are exempt from medical insurance benefit calculations.

|

MONTHS OF SERVICE |

FY 24 |

|

1 |

$1,397 |

|

3 |

$4,191 |

|

6 |

$8,382 |

|

9 |

$12,573 |

|

12 |

$16,769 |