Hands-on learning is real-life problem-solving.

For Jabril Al-Hamdy, substance matters. When you’re in charge of $500K of somebody else’s money, you learn some things. How to assess risk. How to ask for help. How to pay it forward. How to win in ways you never thought possible. JMU sets the table. Al-Hamdy and his team are cooking their way to some bright futures.

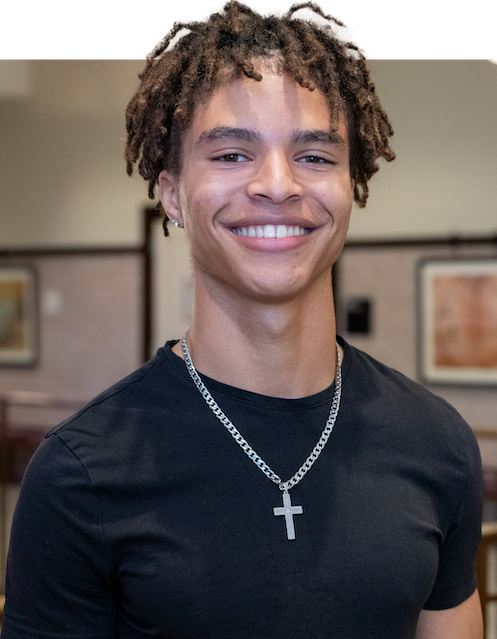

Jabril Al-Hamdy - Class of 2024

Major: Finance

Hometown: Woodbridge, Virginia

High School: Garfield High

Highlights: One of JMU’s first two undergrads to pass the CFA Institute’s Chartered Financial Analysts Level I Exam; College of Business Student Advisory Board participant; President and ESG Portfolio Manager for the Madison Investment Fund; is helping lay the groundwork for Duke Support Network, a peer-to-peer mental health support club; recipient of the Dingledine-Bluestone Scholarship and the A.J. (’92) & Beth Fischer Scholarship Endowment in Finance for the College of Business.

Q&A With Jabril

Explain the Madison Investment Fund.

What we do is we manage a portion of the university's endowment, currently valued at about $500,000. So we're doing real stock pitches, really getting a great hands-on experience that kind of takes things that you may be learning in the classroom and puts them in a real-world setting.

It sounds intense.

We do have that fiduciary responsibility. But on top of that, and really what I'm really passionate about, with the organization is the career development side. We have a great alumni network. We have people going back years and years who have designed trainings for us to give to new and current members. It really is a fantastic professional development opportunity.

Explain how the fund works.

There are seven sectors, and these are like different industries. There is tech, healthcare, industrials, consumers, energy, ESG, which is our sustainability group, and financial. We also have our portfolio management group, which is a separate group. What it does is take this holistic view of all our different stocks so when we want to buy a new company, portfolio management runs a lot of different quantitative tests on the back end to see if this this a good fit with what we already have.

So how many people are involved in Madison Investment Fund?

There are 20 full-time members and then about 20 of our potential new members who going through the training process for six to eight weeks that culminates in a big final project to hopefully get full-time admission into the organization.

Do you have a hand in the training yourself?

Absolutely yes. I have had a hand in the training for about three years now and am the fund’s president, so I kind of oversee everything. It’s two sessions a week roughly with these presentations that have been created and cultivated by current members and alumni over the years to give the best picture of practical application of finance and economics and things of that nature. How to fundamentally analyze a business, what a good pitch looks like and so on.

So what's next?

This past summer I had the incredible opportunity to intern up in New York and got a full-time return offer there at the firm Brinley Partners with their credit fund up in Manhattan. So I'll be going back really excited.

Did JMU help with securing your internship?

My time in the Madison Investment Fund mattered, along with talking to a JMU alumni—one who was specifically at the firm—which I’m sure helped me with the opportunity to interview when they opened up applications.

Did you feel qualified for the internship?

Over the summer, what I found was a lot of the hands-on experience I had gotten through the fund was super helpful in my internship experience. Being able to analyze companies, understand economic trends, and just go through the news and kind of connect the dots to how that might affect a company that's being looked at is a really important skill and one I've definitely cultivated during my time here.

Describe the first time you walked into the Madison Investment Fund facility.

It’s incredible that we have the Gagliotti Capital Markets Lab and have the Bloomberg terminals there, which is the premier finance data software. And with the fund itself, the older members do a really good job of mentoring you how to go through that and really pick out data or information that might be the most important. It’s truly a fantastic experience.

More Profiles